Pakistan’s first consolidated data platform offers real time climate and energy data; confirming that focus needs to be steered away from hydropower

By: Syeda Masooma

“We don’t need large hydropower projects. They require massive investments and lack flexibility. They are not necessary in our energy generation mix. We should instead focus on distribution,” said Ubaid Ullah Khan, a research associate at Renewables First (RF), a Pakistan-based think tank focused on energy and the environment.

Part-II: True cost of hydropower – the underbelly of Dasu dam

Ubaid spoke during a panel discussion organised by RF on affordable and sustainable energy generation in Pakistan. Addressing the country’s power generation and the Indicative Generation Capacity Expansion Plan (IGCEP), he emphasised that Pakistan would benefit more by focusing on improving electricity distribution rather than expanding generation capacity.

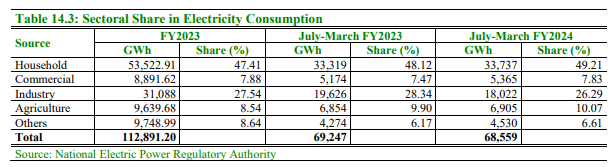

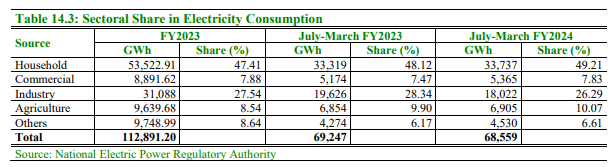

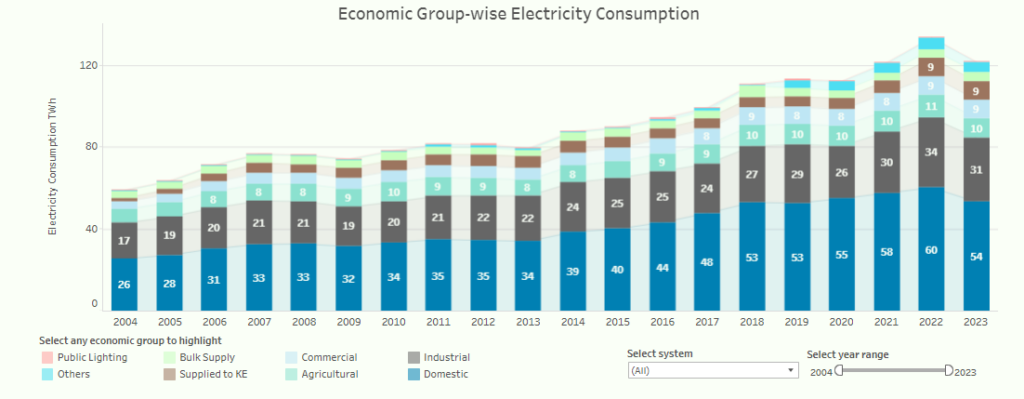

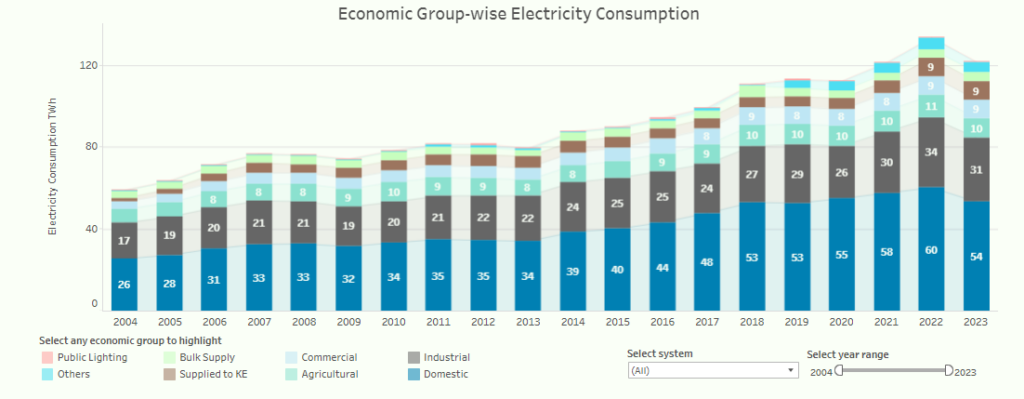

Pakistan already has excess generation capacity, with a continuously declining demand for electricity, particularly due to the increasing use of solar panels across the country. In 2023, demand for grid electricity – power supplied by distribution companies (DISCOs) – fell by nearly a sixth. According to the Economic Survey 2023-24, the installed capacity of electricity rose from 41,981 MW in FY2022-23 to 42,131 MW in FY2023-24, while total electricity generation dropped from 128,962 GWh to 92,091 GWh. Over the same period, demand for electricity fell significantly from 112,891 GWh to 68,559 GWh.

The World Bank’s report, “The Dynamics of Power Sector Distribution Reforms”, highlighted the challenges facing Pakistan’s industrial sector, which contracted by 1.2 per cent in FY2024, following a 3.7 per cent decline in FY2023″.

The report also noted that despite lower global energy prices, domestic energy tariffs increased, leading to energy inflation rising in urban areas from 40 per cent year-on-year in FY2023 to 63.6 per cent in FY2024. In rural areas, energy inflation eased to 25.4 per cent due to the exclusion of gas from the rural Consumer Price Index (CPI).

Transitioning Pakistan’s CFPPs to renewable energy: what’s the hold up?

The report also detailed the power sector’s growing deficit, which has surged due to high generation costs, distribution losses, delayed tariff changes, and unfunded consumer subsidies. Servicing debt from the Power Holding Private Limited (PHPL) further exacerbates the financial strain.

Another report by RF and the Policy Research Institute for Equitable Development (PRIED), titled “Powering Pakistan’s future: Pathways to optimize affordable and sustainable Energy Generation beyond IGCEP 2024-34” predicts that Pakistan’s installed capacity will reach 56.8 GW by 2033, a slight increase from IGCEP’s prediction of 56.04 GW.

“Despite an excess in generation capacity, more hydropower projects are being added, even though the increasing use of solar energy is likely to reduce demand further”

Syed Faizan Ali Shah, intergration and power systems expert at RF

The panel discussion also addressed the ongoing focus on expanding generation capacity without sufficient attention to distribution infrastructure and actual demand. Hydropower was a key topic of debate, with several experts concurring with Ubaid’s stance.

Syed Faizan Ali Shah, an expert in integration and power systems at RF, pointed out the seasonal limitations of hydropower, noting that it provides insufficient power during winter months when energy demand peaks at night. He reiterated that despite an excess in generation capacity, more hydropower projects are being added, even though the increasing use of solar energy is likely to reduce demand further.

Faizan also expressed concern over Pakistan’s lack of a mechanism to regulate distributed power generation, noting that while data on solar panel imports is available, there is no information on where they are installed or how much power they generate.

Umer Farooq, from LUMS Energy Institute, concurs. He said, “Hydropower projects are not ‘secure’, which means that they are not flexible to the needs of the market. They are huge investments, often financed by global lenders and multinational loans which makes it impossible to stop or rescind their operations in line with the changing demand trends”.

Microhydro power: lifeline amidst disasters & a blueprint for RE

Offering an alternative perspective, Anila Fatima, CEO of One Network, acknowledged the strategic and political importance of hydropower projects, particularly for addressing water scarcity and supporting agriculture. However, she criticised the current approach of passing the costs of these projects onto electricity consumers.

Anila proposed that the cost recovery for hydropower should be shared between water and electricity bills. She argued that this would not only help reduce power sector deficits but also encourage more responsible water usage. “If water bills are raised while electricity bills are reduced, consumers won’t face any additional financial burden. However, they may feel less frustrated with the electricity sector and are likely to use water more responsibly,” she concluded.

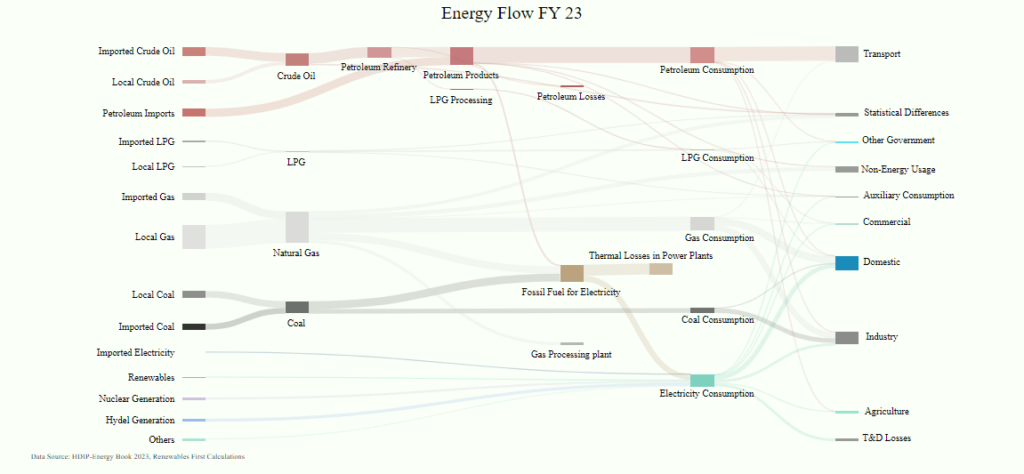

‘Pakistan’s Energy and Climate Insights dashboard’ integrates data from key entities, including NEPRA, NTDC, and DISCOs including KE, and other relevant organisations

What makes all these discussions more potent is that Pakistan now has consolidated data to support many of these arguments.

A recent initiative by Renewables First (RF) and the Policy Research Institute for Equitable Development (PRIED) has led to the launch of the “Pakistan’s Energy and Climate Insights” dashboard. This platform integrates data from key entities, including the National Electric Power Regulatory Authority (NEPRA), National Transmission & Despatch Company (NTDC), and Distribution Companies (DISCOs), as well as Karachi Electric (KE) and other relevant organisations. The dashboard is publicly accessible, and efforts are underway to upload historical data, enhancing its utility for analysis.

Climate change: exploring the link between carbon emissions and heatwaves

Rabia Babar, RF’s Energy and Climate Data Manager, highlighted the importance of this tool, saying, “We now have real-time methane emissions data available on our dashboard, which means policymakers can no longer claim a lack of data as an excuse when formulating climate policies. The maximum lag, even if there is one, will be of one to two days”.

“This was necessary to bring in investment in Pakistan’s energy sector as much as it was necessary to improve data transparency and investors’ confidence,” Rabia said.