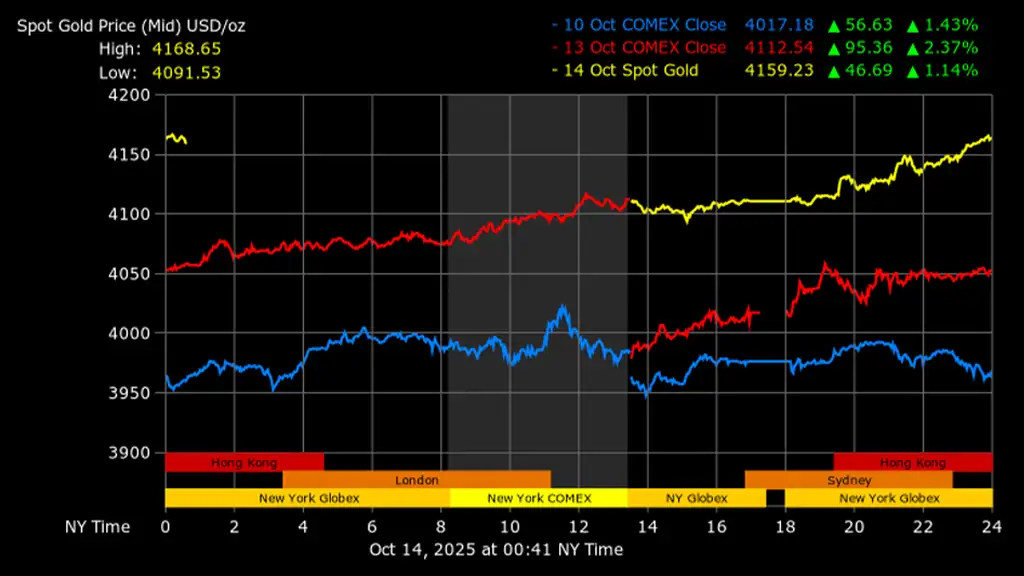

WASHINGTON: Gold prices reached a new record high above $4,100 on Tuesday as growing expectations of US Federal Reserve rate cuts and renewed trade tensions between Washington and Beijing drove investors towards safe-haven assets.

As of 0341 GMT, spot gold was up 1.3 percent at $4,162.31 per ounce, while US gold futures for December delivery rose 0.9 percent to $4,171. The precious metal has jumped 58 percent so far this year, breaking the crucial $4,100 mark for the first time on Monday.

Fed cut bets fuel demand

The latest surge was supported by hopes that the Federal Reserve will continue to cut interest rates, easing borrowing costs and making non-yielding assets like gold more attractive.

Philadelphia Fed President Anna Paulson said rising risks to the US labour market strengthen the case for more rate reductions. Traders are now pricing in a 97 percent chance of a rate cut in October and 90 percent in December.

Investors are awaiting Fed Chair Jerome Powell’s speech at the National Association for Business Economics (NABE) annual meeting later on Tuesday for further guidance.

Kelvin Wong, senior market analyst at OANDA, said the rally is being driven by growing bets that the Fed will stay on its rate-cut path, lowering long-term funding costs and reducing the opportunity cost of holding gold.

Analysts raise gold outlook

Gold’s rally has been underpinned by a mix of geopolitical uncertainty, economic slowdown fears, strong central bank buying, and rising inflows into exchange-traded funds.

Analysts at Bank of America and Societe Generale expect gold to reach $5,000 by 2026, while Standard Chartered raised its average forecast for that year to $4,488.

Silver also rode the wave of safe-haven demand, climbing 1.1 percent to $53.13 after hitting a record $53.45 earlier in the session. Market analysts said the surge reflects both investor appetite for precious metals and tightness in the spot market.

Trade tensions return

Adding to the bullish sentiment, tensions between the US and China have flared once again. China recently announced plans to expand export controls on rare earth materials, prompting President Donald Trump to threaten 100 percent tariffs on Chinese goods and new restrictions on US-made software exports starting November 1.

Despite the escalating dispute, US Treasury Secretary Scott Bessent confirmed that Trump is still expected to meet Chinese President Xi Jinping in South Korea later this month to discuss trade and security issues.

Meanwhile, the ongoing US federal government shutdown, now in its 13th day, is starting to weigh on economic activity, Bessent warned.

Elsewhere in precious metals, platinum rose 1 percent to $1,661.70, while palladium advanced 2.2 percent to $1,507.50.

Gold rate in Pakistan

Gold prices in Pakistan climbed to another record high on Monday, extending their streak of all-time peaks as investors continued to seek safety in the precious metal amid global uncertainty and growing geopolitical tensions.

According to data from the All-Pakistan Gems and Jewellers Sarafa Association (APGJSA), the price of gold per tola jumped by Rs5,500 to reach Rs428,200, the highest level ever recorded in the country. The rate for 10-gramme gold also increased by Rs4,715, settling at Rs367,112.

Read next: Hopes for US-China trade deal lift global oil prices